Industries

Financial Services

Safe, secure, and high-quality transactional efficiency

Financial Services, including industries such as Banking and Accounting in addition to Finance functions within other organizations, offer significant opportunity for process optimization. They are often very fertile fields with leaders who know how to measure and appreciate impact, driving the process change to improve the bottom line. If transaction counts are high and dependent on accuracy, as is the case with banking and internet transactions, operating at levels even better than Six Sigma (near perfection) is a key factor in business continuity.

Security becomes an urgent priority as financial service providers must ensure every transaction is captured, monitored and available for analysis within microseconds of occurrence. Leaders who are responsible for these processes understand the need for flawless processes which are reliable, consistent and repeatable. Leveraging the knowledge of front-line employees to drive excellence using problem solving techniques, failure modes and effects analysis and risk assessment ensures the entire organization can identify and resolve issues which impede safe, secure, high-quality transactional efficiency.

Automation is key to this industry as is risk identification and process compliance.

How We Helped

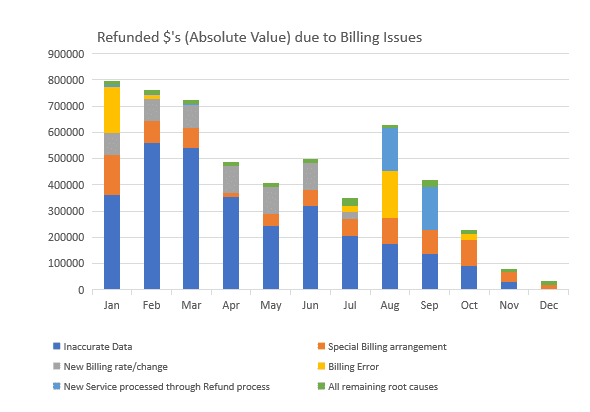

Centralized IT Billing shared services team focuses on eliminating manual steps, setting up a governance process and reducing rework to satisfy internal customers receiving IT bills.

Problem: A centralized billing process responsible for billing $750M of IT products and services, including Compute, AS400, Corporate Services, and Telecom services had complaints from customers that the process was not transparent, difficult to use, untimely and required significant rework.

- Developed survey method and established monthly meeting with product owners receiving the billing to obtain feedback and address concerns.

- Documented value stream map of billing process to identify and address manual process steps, defect causing steps, excessive resources required and bottlenecks driving high cycle time to process billing.

- Created a governance process to ensure refund requests were handled with standard, approved process.

- Improved reporting based upon feedback from the product community (customer base)